We’ve discussed several ways to save on the blog, but if someone asked me for my top 5 tips on how to save money, this is what I would say!

Although it may seem like food is my life, especially on Instagram, where I share recipes almost daily on stories, I’m even more passionate about being frugal. Some would even call me cheap, ha! Recently, a friend asked for my top 5 tips on how to save money, and I LOVE this question. As mentioned above, I’ve written several articles on how to save money, but narrowing it down to just five tips was a challenge!

If you’ve been here long, you already know that one of my biggest pet peeves about most online advice is that it’s unrealistic and repetitive. Unfortunately, a LOT of information is copied and pasted from other sites. It’s redundant and unrelatable. I don’t want to throw shade at anyone else, but sometimes, whoever writes those articles seems out of touch with reality, and the advice is almost laughable.

My Top 5 Tips On How To Save Money

Everything I write about on this blog will always come from personal experience. Whether it’s how to save money, cook affordable and delicious meals, make extra money, or save money on food, I have been there and practice what I preach. I’m a no-BS person, and I’ll never give advice I don’t truly believe can help someone else. Do we go to Disney World every year? Yes. We sure do, and we can afford to do that because we live a very frugal lifestyle every other day of the year. These are my five tips for saving money—and exactly what I would do if I needed to save money quickly!

Immediately Stop Spending

If you’re researching ways to save money while drinking a nine-dollar drink from Starbucks, you’re not in the right mindset. Mindset is everything. It’s not just a coffee. It’s nine extra dollars that could still be in your bank account. Nickels and dimes add up, and little splurges will sabotage you. Frivolous spending has to stop immediately.

We intentionally choose to save money every day. This morning, I went to my chiropractor. I was starving when I left his office, and every part of me wanted to stop at my favorite little sushi place, but I didn’t. I told myself there was food at home, and I didn’t need to spend the money. Making these little sacrifices will all be worth it when we reach our goal, and they will be for you, too!

To get your spending in check, put a spiral notebook on the kitchen counter. Don’t use your phone or any fancy apps. An old-fashioned spiral notebook right on the counter is something you’ll see twenty times a day, so you won’t forget. Every day, write down anything you spend. Whether it’s a Coke from the vending machine at work or lunch at McDonald’s, physically write it in the notebook. There’s something about seeing this daily that really helps keep you in check. The first time we did this, we were shocked at how much we had spent at the end of the month. It helps you clearly see what you can cut back on.

Stay Home + Do Free Stuff

Staying home is one of my favorite tips on how to save money, probably because I’m a homebody, ha! By staying home more, we save money by not spending money. However, you can’t always stay home and don’t have to sacrifice fun when trying to reach your goal!

Many communities offer free events like movies in the park, outdoor concerts, festivals, and more. At these events, stations are often set up that offer free activities for kids. Your children do not care how much money you are or are not spending on them. What they remember is that you were together and having fun.

For adults, these events can be just as meaningful. Here in Nashville, we have many free concerts at various parks around town. Shannon and I will pack a picnic using whatever we can find at home, bring a blanket, and enjoy a free evening listening to great music and socializing with others. You don’t need to spend a dime to have a great time and make memories!

Family game nights or hosting a game night at home with friends is one of our all-time favorite things to do. The adults have fun playing games and socializing while the kids run around the house having fun. Ask everyone to bring a dish, BYOB, and you have a free or low-cost evening making happy memories.

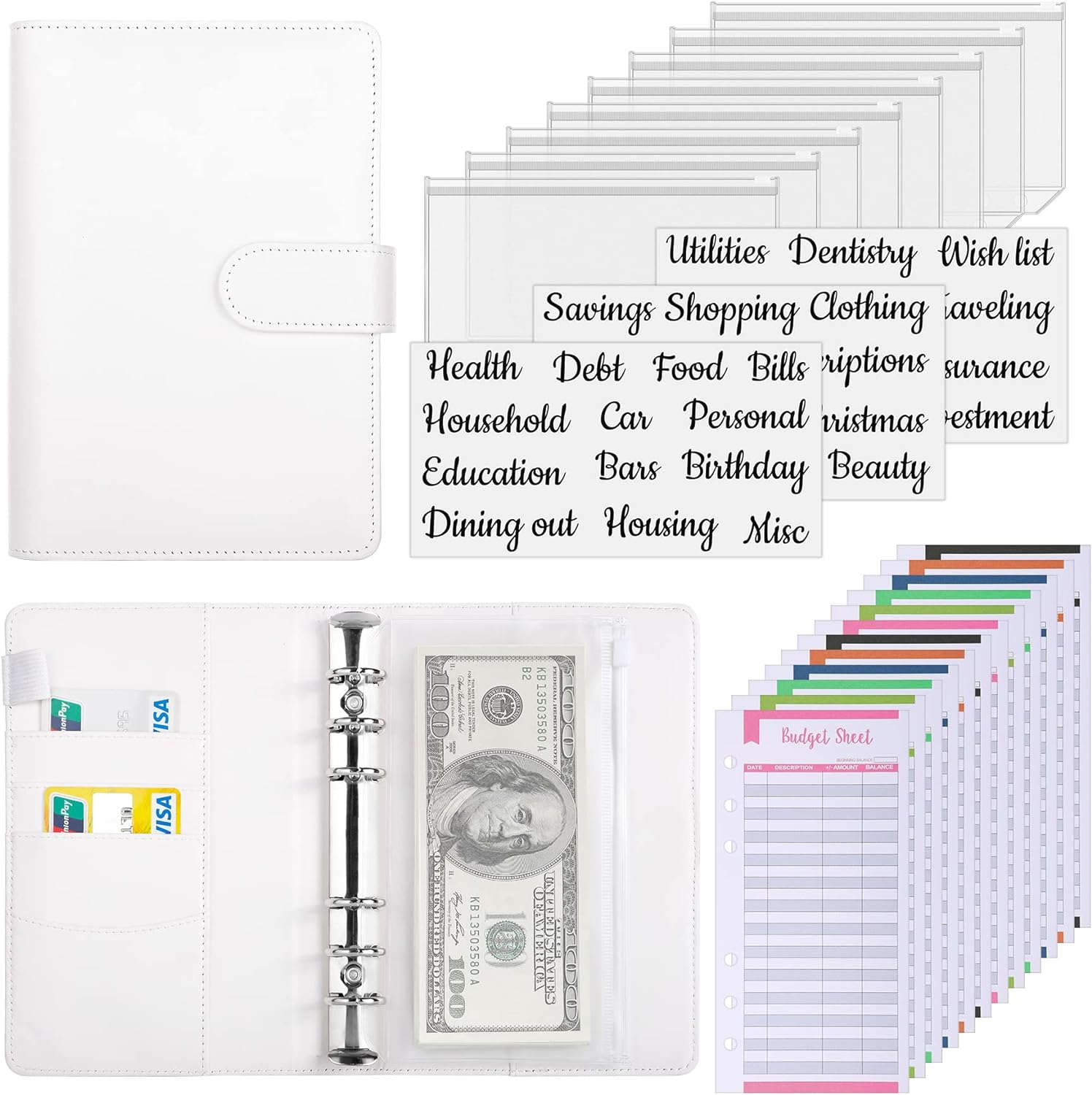

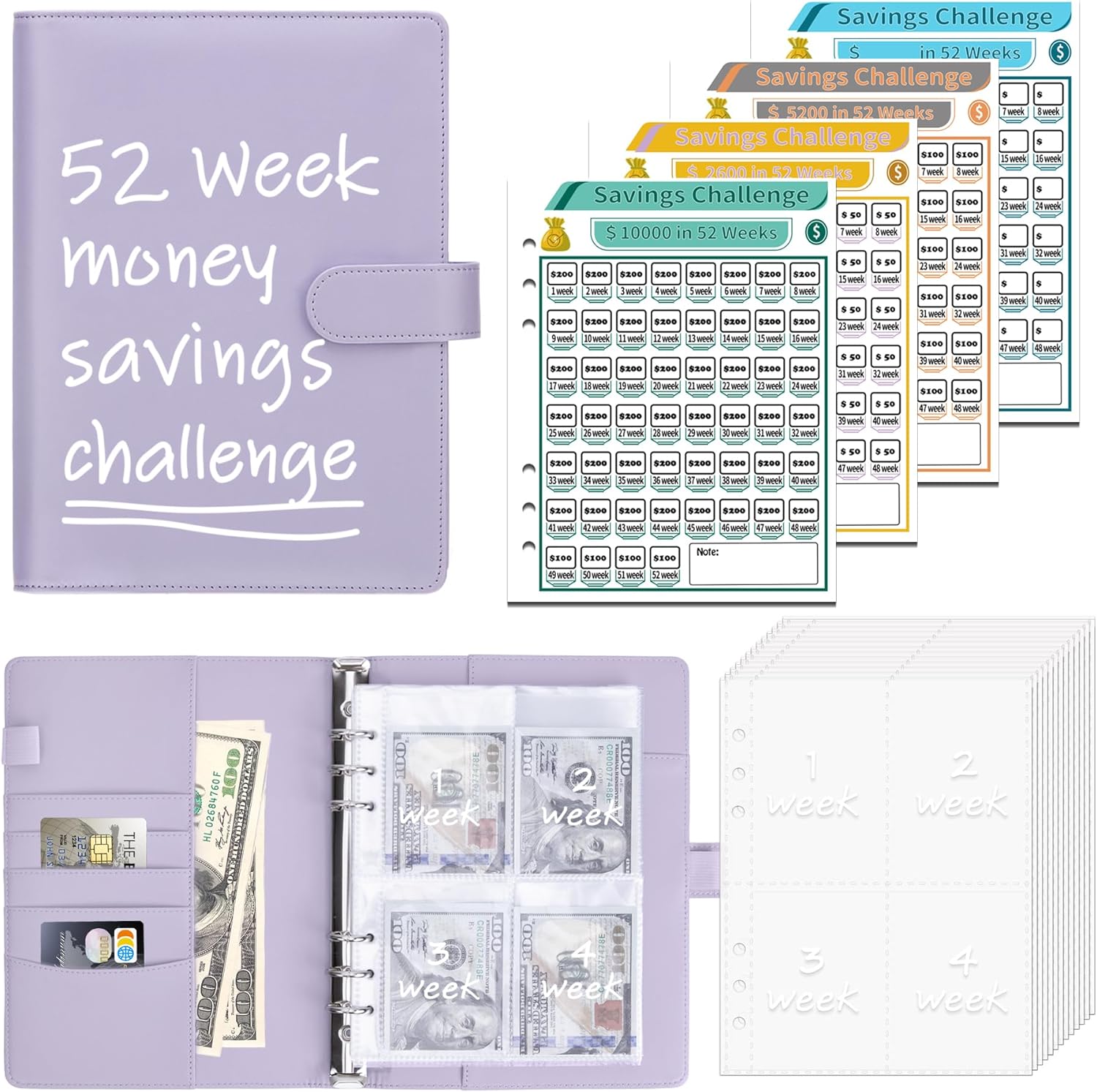

Budget Planning Tools | ||

Cut Household Expenses

Go through all those subscriptions on your phone and cancel any that you don’t use or don’t use often. I do this several times a year and always save a little on my monthly expenses.

Cut cable or find an alternative. I recently canceled my internet through AT&T, and my son added me to his T-Mobile account. I pay half the bill, about $22 monthly, saving me $88. You also don’t need five streaming services. Pick two or three you use the most, and cancel the rest.

How long has it been since you shopped around for lower insurance rates? You might be surprised how much you can save, especially if circumstances have changed. When I switched from our small hometown insurance company to State Farm, I saved over $100 a month! Another strategy is to call your current insurance company and tell them you’re thinking of switching. They typically want to keep your business and are willing to offer you a better rate.

Save Money On Food

This is a big one because food is a necessity, not a want, and it’s usually the biggest expense for most families. We have several posts about saving money on food, but there are a few more things you can do to cut your food expenses.

Cook from scratch. Simple home-cooked meals will always be cheaper than ordering in or going out. Focus on uncomplicated meals using affordable ingredients. Meals like my easy beef goulash and tuna pasta salad are great examples of inexpensive meals that are easy and delicious. Make a double batch and pack up the leftovers for lunches throughout the week, which brings me to my next point.

Pack your lunch. My family loves leftovers, so they never go to waste. In fact, when my kids were growing up, they preferred leftovers over packing a lunch or buying the school lunch. Sandwiches are also an easy and affordable choice.

Ingredients like pasta, rice, and potatoes are great ways to stretch your meals. Add cooked rice to your favorite meatloaf recipe, or make porcupine meatballs. You’ll nearly double the amount of food for less than a dollar.

Plan your menu around what’s on sale. If your family prefers chicken breast but chicken thighs are what’s on sale, buy the chicken thighs. If you like lean ground beef, but 80/20 is on sale that week, buy the fattier beef and drain off the grease. You get my point. You have to be willing to compromise if you’re trying to save money.

Get A Side Hustle

Remember that a penny saved is a penny earned, and a penny earned is extra money you can save. I’ve written several posts on how to make extra money, and if I needed to save money quickly, one of the first things I would do was find some easy ways to make money.

My husband has a full-time job, but he’s driven for Uber for years. It’s easy to make some extra cash, and he’s a people person, so he truly enjoys it. Sometimes, he doesn’t drive for three months, and sometimes, he goes out a few times a week.

Another quick and easy way to make extra money is to sell stuff on Facebook Marketplace. One of my best friends makes loads of money doing this! We all have things in our house that we no longer need or want, and one man’s junk is another man’s treasure. I’m constantly amazed by the stuff that she sells that other people want to buy, lol!

That’s my top 5 tips on how to save money! I hope it helps you. Please share your best tips in the comments below!

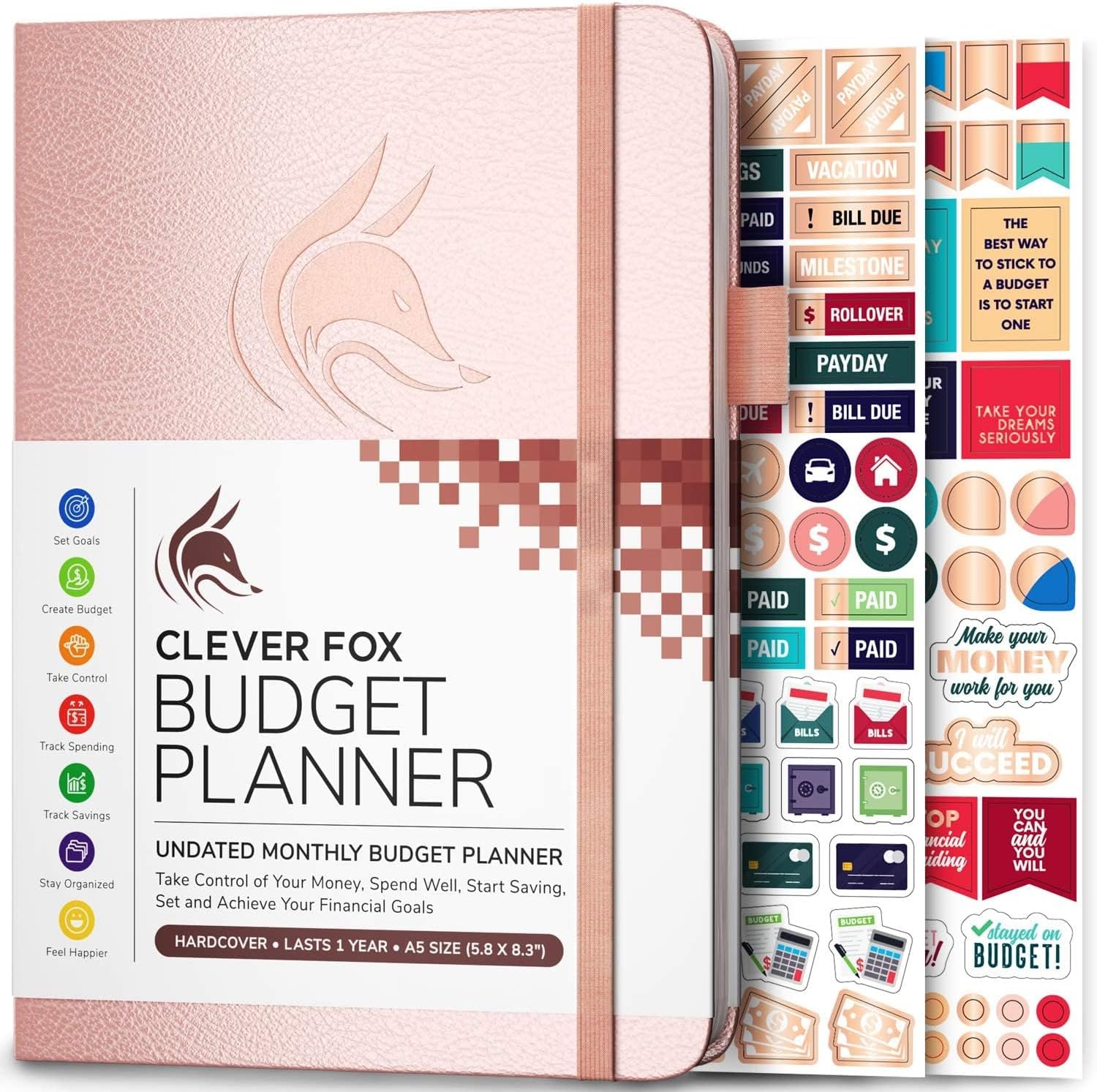

Helpful Tools | ||

I hope this is helpful! If you have any tips you'd like to share, please let us know in the comments below. Be sure to follow me on Instagram, Pinterest, or Facebook, and sign up for my email list so you don’t miss anything new. Thanks for being here, friends ♥ |

More Money-Saving Posts You May Enjoy

- 25 Ways to Save on Groceries Each Month

- How to Grocery Shop for One Person

- Realistic Ways to Save Money Each Month

- How To Save Money on Fresh Produce

Leave a Reply