Do you need ideas for realistic ways to save money each month? We got you! Read on for strategies we use ourselves that work!

From an early age, my Dad instilled in us the value of hard work and living within our means. I vividly remember him saving his change all year and having us kids roll it for vacation. He gave us each $20 for doing it, which was our vacation spending money. If we wanted extra money for something like school clothes or makeup, we were given a chore to earn it. It was rarely just handed out. Because of this, I became a bit obsessed with saving my money. To this day, I’m always looking for creative ways to save money each month, and many of the things on this list came from my dad.

Money saved is money earned. Read that again.

Money you don’t spend = money saved = money earned. It’s that simple!

My dad also kept track of every penny he spent. He always wore shirts with pockets and kept a small notebook there. If we stopped at 7-Eleven or picked up fast food, he’d take that notebook out and write down what was spent before driving away. I watched him do this every day of my life. While I don’t have a notepad, I do have a spreadsheet, and I know where every dollar of my money goes.

Keeping Track Is Crucial

The first thing I do every morning is make coffee, sit down at my desk, open my budget spreadsheet, log in to the bank, and enter any transactions that came in overnight, as well as what we spent the previous day. It takes five minutes! To SAVE money, you must know where your money is going.

My spreadsheet columns are income, monthly bills, necessary spending, and frivolous spending.

- Income is ANY money that comes in (paychecks, side jobs, selling things, etc)

- Monthly bills are mortgage, utilities, car payment, insurance, etc…

- Necessary expenses include groceries, gas, home repairs, medicine, etc.

- Frivolous spending is eating out, coffees, that new purse you wanted but didn’t need…

There is a total at the bottom of each column, so it’s very easy to see what we did right or wrong each month. For example, this month, we went about $135 over our budget for frivolous spending. A quick look at that column revealed that we hit up Starbucks more than usual, so we’ll do better next month. Those small debits add up, and this helps keep you in check. There is NO wondering where our money goes.

You must be willing to do this first! It can be as simple or elaborate as you want. My husband and I kept a notebook on the counter that we wrote in daily for a long time. Find what works for you, and start!

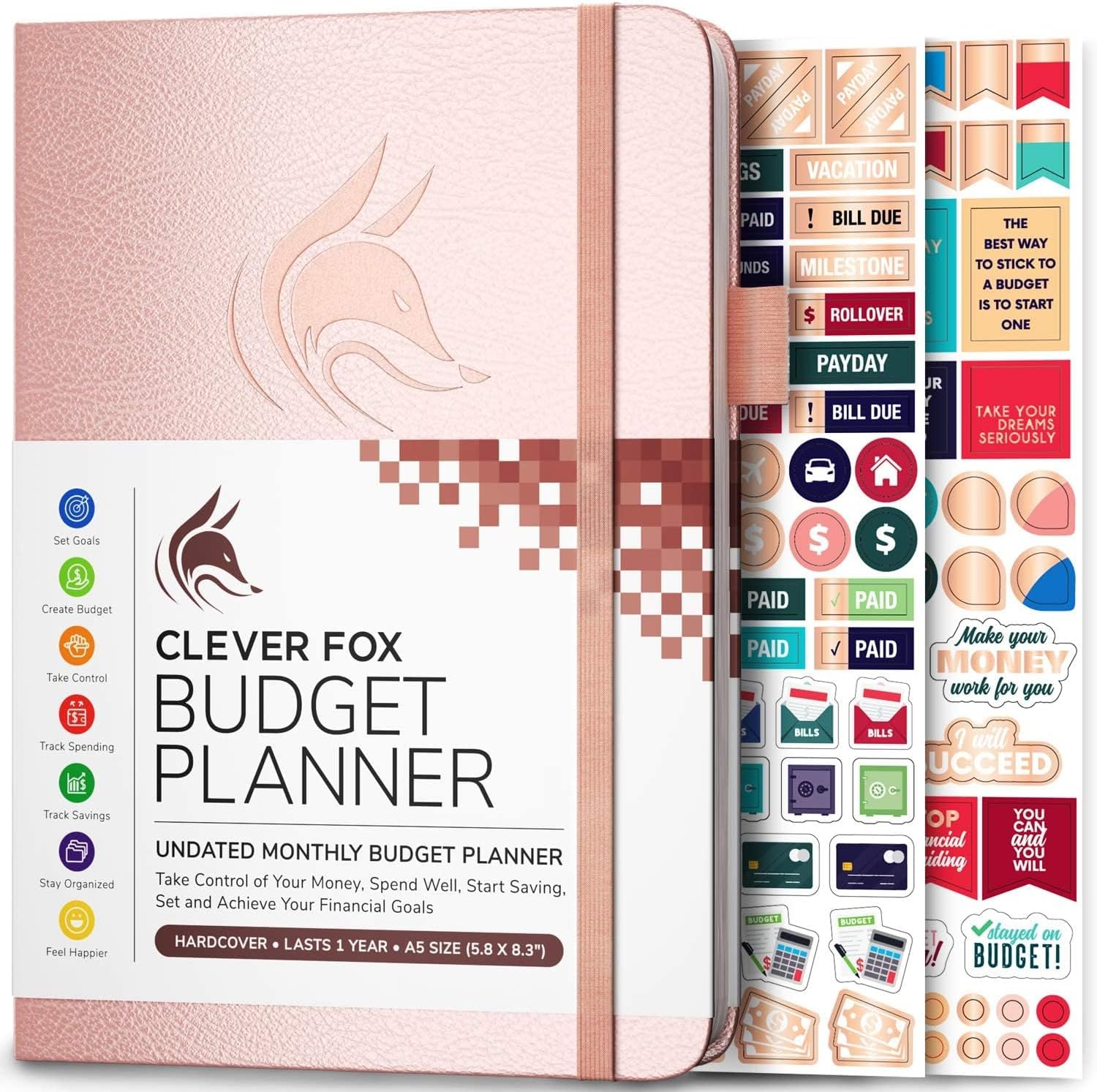

Helpful Tools | ||

Ways To Save Money Each Month

Now, let’s discuss some realistic ways to save money each month. If this list seems overwhelming, you don’t have to do all of them at once. Choose a couple of things from it and start there. Don’t make the mistake of thinking small savings don’t matter. Nickels and dimes add up, and small changes can make a big difference over time.

Don’t Be A Brand Snob

- Buying generic can save you money, and you may even discover new, more affordable products you love. For example, non-organic Swanson broth is almost three dollars at most grocery stores. At Aldi, the organic broth is less than two dollars.

Cancel What You Don’t Use

- Review your monthly expenses and cancel anything you no longer need. For example, are you using that gym membership? My husband paid around $20 a month for a gaming membership that he rarely used. I was paying $29 a month for an image plan that I had forgotten about. Just canceling those two things saved us almost $50 a month.

Cut The Cable

- Cable is costly, and you can watch pretty much anything you want on Netflix, Hulu, Apple TV, or Amazon Fire TV Stick. We already pay for several streaming services, and they all cost less than our cable did!

Negotiate Bills

- This is one of my favorite ways to save money. Twice a year, I call my cable, cell phone, and insurance companies and ask for a lower rate, and I don’t beat around the bush. I come right out and ask them what they can do to lower my bill, usually after reminding them that I’ve been a long-time, loyal customer. Every time that I do this, I come out ahead.

Buy Used

- Clothing and furniture are just some things you can buy on the Facebook marketplace, Craigslist, and OfferUp. While there, you can also sell some of your things and make some extra cash!

Check Your Hobbies

- Hobbies are fun, but they can be very expensive. Even though I cook for a living, it’s also a hobby of mine. Groceries can get costly when you’re recipe testing and experimenting in the kitchen, so I try to be intentional about what I buy. My husband loves fishing and needs minnows and tackle whenever he goes out. He had no idea how much it cost us until I showed him our spreadsheet. Since then, he’s found a new bait store where minnows are cheaper and is using more artificial bait.

Shop At Closeout Stores

- Here in Nashville, the most popular closeout store is Bargain Hunt. I make a point to stop in regularly, as inventory changes quickly. Our store has a LOT of overstock from Target. When we need something specific, I’ll check Bargain Hunt before I go anywhere else. My husband got all the gardening tools he needed at a fraction of the price. Other popular chains are Ollie’s, Dirt Cheap, and Treasure Hunt. Stores like Dollar Tree and T.J. Maxx are NOT true closeout stores. An actual closeout store buys up the overstock from big-box stores and sells it at a drastically reduced price. You often see the original stickers on the products.

Find Free Events

- These days, almost every city has free events that can be found on its website, Eventbrite, social media, etc… My favorite way to keep up with local events is to follow my favorite local bloggers, who post that kind of content. Make a date night out of it. Pack a picnic, attend a free event, and BYOB whenever possible. Paying for drinks adds up quickly. Free events are such a great way to save money without sacrificing fun!

Reconsider Organized Sports

- Honestly, I was always thankful that my kids had no interest in sports. I had several friends who had kids in sports, and I can’t tell you how many conversations we had about how expensive it was. Sometimes, it can cost upwards of $100 a month per child. If you want your children to be involved but can’t afford organized sports through the school, consider volunteer programs, community projects, and hands-on activities specifically designed for children. You could also form a group with other mothers and develop a neighborhood sport or activity.

Earn Cash Back On Purchases.

- If you shop online, consider using Rakuten, a rebate site that gives you cash back on your purchases. I have been a member for years and regularly earn up to $600 a year in free money on my purchases. They even have a browser extension that makes it virtually impossible to forget. For example, when you go to worldmarket.com, the browser extension prompts a pop-up that reminds you to activate your cash back. They make it incredibly easy to use!

Pro tip. If I find something I want while out shopping, I take a picture of the product number and then order it at home. The price is usually the same online, and I earn cash back for my purchase.

Trade Services

- I love doing this! I cook all day, every day, but I have friends who hate cooking. Some of them own small businesses and are always happy to trade products or services for a home-cooked meal!

Rent Equipment Instead Of Buying

- We literally just did this. My husband wanted to cut down all the trees and bushes that had grown up in the back of our yard, and needed a chainsaw. At the time, we didn’t even know you could rent things like this from Home Depot and Lowe’s, but you totally can! Instead of spending God knows how much on a chainsaw he would rarely use, he rented one for $75 a day.

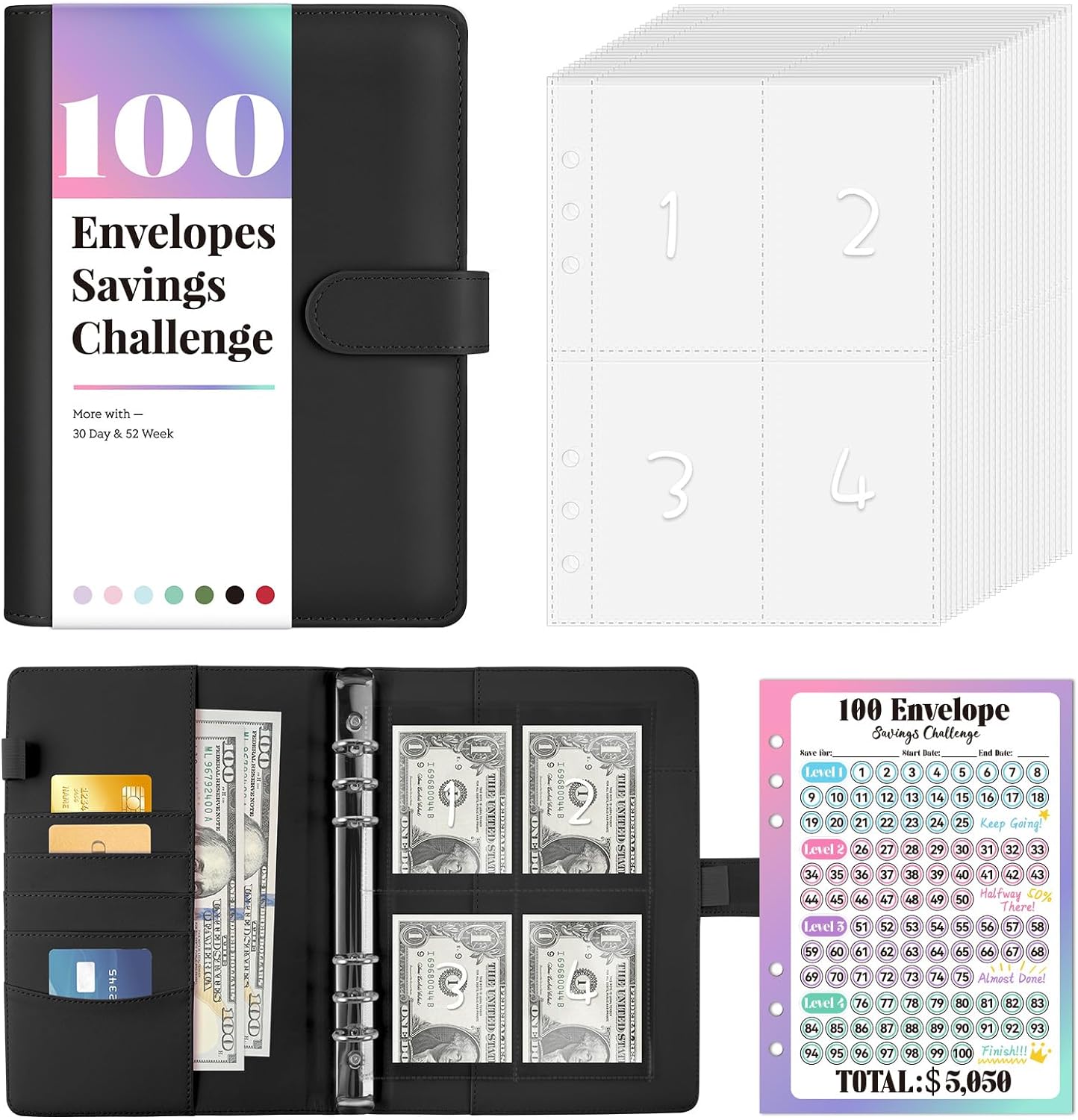

Helpful Tools | ||

A Few More Ways to Save Money Each Month

- Men’s haircuts can be pretty easy to do with a bit of practice. Wahl has a great little haircut kit that’s a perfect place to start. It’s a little more upfront, but will save a lot of money in the long run.

- Get cash back at the register instead of going to an ATM and paying fees.

- The next time you get a prescription filled, ask if the generic is cheaper and make the switch.

- DIY gifts will not only save you money, but they’re more meaningful. I can honestly say my favorite gifts are always handmade.

- Stop smoking, vaping, etc.! It costs a fortune, and it’s terrible for you!

- Don’t pay others for what you can do yourself. My husband and I are pros at googling everything and figuring it out ourselves. If we have to hire someone, you can bet it’s something we absolutely could not do. That even applies to my work. If there’s a glitch on my website, I’ll do my best to fix it myself before contacting my tech guy.

I hope this is helpful! If you have any tips you'd like to share, please let us know in the comments below. Be sure to follow me on Instagram, Pinterest, or Facebook, and sign up for my email list so you don’t miss anything new. Thanks for being here, friends ♥ |

More Money-Saving Posts You May Enjoy

- 25 Ways to Save on Groceries Each Month

- How to Grocery Shop for One Person

- Realistic Ways to Save Money Each Month

- How To Save Money on Fresh Produce

Leave a Reply