We’ve got you covered if you’re looking for ways to save money on a tight budget! Follow these tips, and you’ll reach your goal in no time!

Christmas is right around the corner, so if you’re looking for ways to save money on a tight budget, we’re here to help! One of my biggest pet peeves when you read articles like this is that most of the advice is unrealistic. As someone who truly knows what being broke feels like, I understand how stressful not having extra money can be, especially during the holidays.

Christmas is right around the corner, so if you’re looking for ways to save money on a tight budget, we’re here to help! One of my biggest pet peeves when you read articles like this is that most of the advice is unrealistic. As someone who truly knows what being broke feels like, I understand how stressful not having extra money can be, especially during the holidays.

Since I’m writing this post in October, we’ve got approximately three months to make something happen. You won’t find things like “start a YouTube channel or blog” in this post. That’s not realistic, and we don’t have time for that. It’s October, and Christmas is in three months, so we need money quickly! Having said that, these tips apply to ANYONE who needs money, any time of year.

Ways to Save Money on a Tight Budget

If you’re reading this, I can only assume that money is already tight, so making extra cash will be the quickest way to save it. We’ve got an in-depth post on how you can make extra money here, but I’ll briefly discuss a few of my favorites below. These are things that we have done ourselves, and they work. If you implement some of these strategies, you WILL have extra holiday cash!

One of the first things you’ll need to do is have the right mindset. You must be intentional and make an effort. If you have the right mindset, you should be able to contribute a nice chunk of change toward your Christmas fund. I’m using Christmas as the goal because it’s three months away, and that’s what most people are looking for this time of year. Having said that, use this as a guide to work towards your goals all year long!

Sell It & Save It

I know everyone gets sick of hearing this, but selling things from around your house is a great way to make extra money quickly. Save every penny you make. Don’t spend it!! This will be harder than you think, but keep reminding yourself why you’re doing this to begin with.

You’d be amazed at the things people will buy. My niece goes to Goodwill and buys what I can only describe as junk bags, and she makes a full-time income selling it on eBay. I prefer Facebook Marketplace because it’s user-friendly and has no fees. It’s easy, and I like that you can meet people locally and don’t have to mail anything. That said, there are many online platforms where you can sell things, locally or otherwise.

Don’t ignore the big stuff. We had an old bedframe lying around for about two years, and it sold for $65. The person came and picked it up within three hours of listing it.

Have you got kids? Sell their stuff! Used clothing, toys, and necessities sell very well. Bassinets and newborn clothing are in high demand and sell quickly!

Help Others With Everyday Tasks

AKA, be a handyman. My son has been doing this for about a year, averaging a few hundred dollars weekly. Most people desperately need a good old-fashioned handyman to hang a ceiling fan, install light fixtures, or clean gutters. I put the word out to friends and family on social media, and he has stayed busy ever since. People tell their friends, and word of mouth keeps the jobs coming.

You can also offer to mow someone’s lawn, pressure wash their house, and haul off junk. In the winter months, you can offer to weatherproof their windows, which will also save them money on their electricity bill, a great selling point for my son.

Now that you’ve got some ideas for making extra money let’s explore some ways you can do it on a tight budget!

Start A Budget Now

The biggest hack for saving money is knowing where every penny of your money goes and being in control of it. You’d be surprised how many people think they don’t have any extra money, only to be shocked once they start keeping track of it.

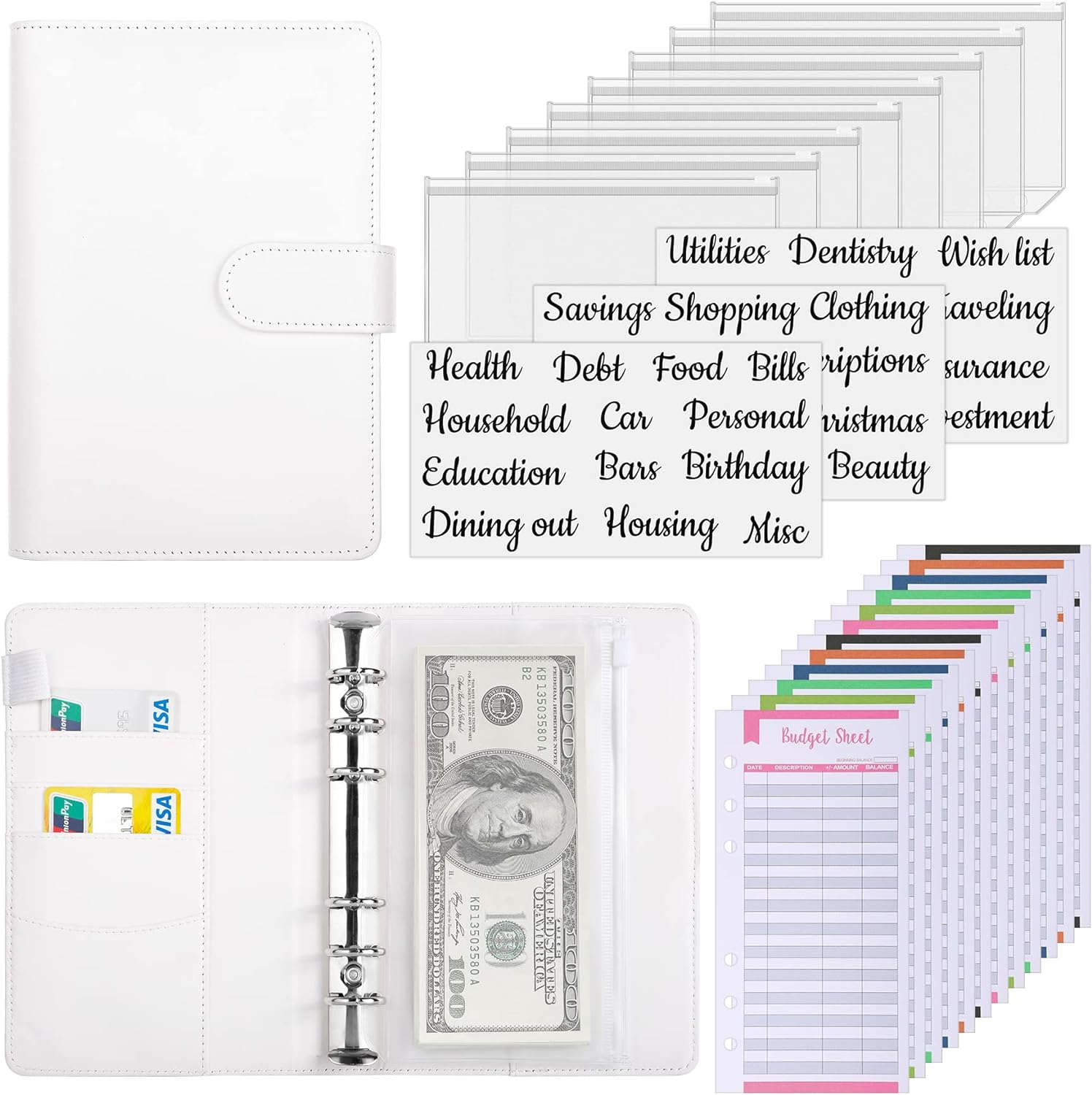

It doesn’t matter how much money you do or don’t have. Take an honest look at your spending, and you’ll likely find areas to improve. Start keeping track of everything you spend. You can do this in a notebook, a spreadsheet, or find a user-friendly app. Do what is easiest for you, and you’ll be more likely to keep up with it. This expense tracker is great and makes it super easy!

The first time I did this was nearly 20 years ago, and it was a big eye-opener. I put a cheap notebook on the counter, and at the end of each day, my husband and I wrote down anything we had spent money on that day. We thought we were doing well and not spending frivolously. Not only were we wrong, we were shocked when we saw what we had spent at the end of the month. I encourage you to do this. It’s the quickest and easiest way to get your spending in check.

Budget Planning Tools | ||

Lean Into Cheap Meals

Grocery shopping is a huge expense for most people, especially if you have a family. Avoid meals that require pricier ingredients and opt for budget-friendly options. A few of my favorites are easy beef goulash, beans and rice, freezer sandwiches, and cabbage and sausage.

Grocery shopping is a huge expense for most people, especially if you have a family. Avoid meals that require pricier ingredients and opt for budget-friendly options. A few of my favorites are easy beef goulash, beans and rice, freezer sandwiches, and cabbage and sausage.

We spend about $600 a month on groceries. If I wanted to save money quickly, I could probably get that down to about $300 by focusing on cheap meals. If I only had two months until Christmas, that’s an extra $600. Remember that money saved is money earned!

Make It Yourself

Dining out, fast food drive-throughs, and Starbucks all have to stop. Pack your lunch, and focus on inexpensive meals like sandwiches and leftovers.

Coffee. Buy your favorite coffee creamer and make your morning coffee to-go instead of driving through somewhere. If you get a $5 daily coffee on your way to work Monday through Friday, that’s one thousand three hundred dollars a year or $108 every month, and that’s only IF that coffee is five dollars. I’m not saying don’t treat yourself. I LOVE a good latte from our local coffee shop, but it’s a once-in-a-while treat.

Meals. It’s easier and more affordable to stretch dinner the night before and pack leftovers for lunch than buying extra groceries. Everyone in my family loves leftovers, so this one is easy for us!

Here are some ways to stretch leftovers and turn them into another full meal.

- Leftover rice can be fried with a bag of frozen mixed veggies and some eggs for fried rice.

- Leftover chili can be mixed with a box of pasta and topped with cheese for chili mac.

- Most leftovers can easily be turned into an egg bake. Anything goes. I do this ALL the time!

- Pretty much any leftover cooked meat can be turned into a soup. Add a bag of frozen veggies, seasoning, and broth, and you have a whole new meal!

Cook From What You Already Have

Challenge yourself to use what you already have in your pantry, freezer, and refrigerator. I actually do this a few times a year. Not only will you save money on groceries, but it also helps prevent food waste. Have fun with it, and get creative!

Purchase a few affordable pantry staples to stretch the ingredients you already have. If you have cans of tuna, make tuna pasta salad or rice bowls, swapping the protein and using what you’ve got for toppings. A side of buttered noodles or rice can be paired with just about anything, and they’re cheap!

There was a time when we were so poor that I found ways to get creative with cheap ramen. Back then, I think they were around six cents a package, and I could feed both my kids for less than fifty cents. Add some frozen veggies and a little butter, and you have an incredibly cheap meal!

Food is a major expense, so the more you can save, the more money you’ll keep in your bank account!

Affordable Pantry Staples | ||

Cancel Services You Don’t Use

I recently canceled my DIRECTV and Xfinity services, saving us $248 monthly. Streaming platforms allow you to watch anything you want, even network shows. Pick a platform or two and stick with them. It’s always going to be cheaper than standard cable TV. For the Internet, I use my son’s and pay half the monthly bill, which is only $30.

Look at everything coming out of your bank account and ask yourself what you can cancel. Don’t pay for services that do the same thing. For example, you don’t need three different services to listen to music. Choose one and cancel the others.

Remember the subscriptions on your phone. My husband and I looked at ours a few months ago and canceled most of them. They’re a money trap. Most people forget about them, but those little $2.99 charges add up.

Suck It Up And Sacrifice

I have a tough-love attitude. The world won’t end if you can’t have your favorite brand of water or cookies. Brand snobbery has no place here. Be flexible, buy the cheaper products, and everyone will survive.

Admittedly, the tap water here in Nashville is awful, but cases of bottled water can add up. Consider buying an affordable water filter and save that money.

Ask For A Deferment

Call your mortgage auto loan company and ask for a deferment. Typically, they will take one or two current payments and tack them onto the end of your loan. That’s a big chunk of extra money you can keep in your savings account during the holidays! When my sister was raising four kids alone, she did this every year to have extra money for the holidays.

Save Your Savings

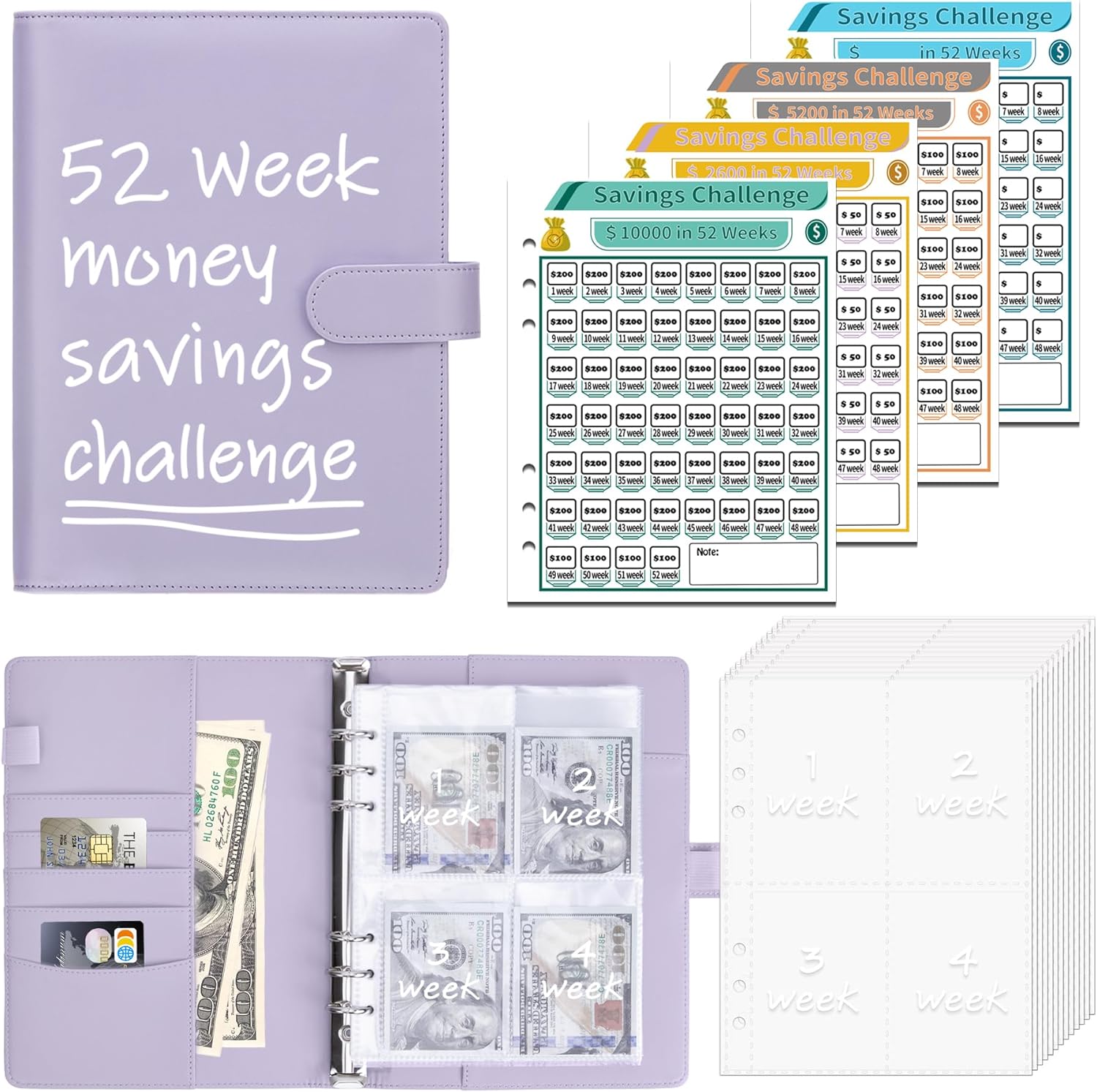

Of course, none of these efforts matter if you’re spending the extra money. Put the extra cash in the bank, and save your savings until you reach your goal!

If you implement the above strategies, you will see more money in your bank account. If you have anything to add to the conversation, please share it in the comments below!

I hope this is helpful! If you have any tips you'd like to share, please let us know in the comments below. Be sure to follow me on Instagram, Pinterest, or Facebook, and sign up for my email list so you don’t miss anything new. Thanks for being here, friends ♥ |

More Money-Saving Posts You May Enjoy

- 25 Ways to Save on Groceries Each Month

- How to Grocery Shop for One Person

- Realistic Ways to Save Money Each Month

- How To Save Money on Fresh Produce

Leave a Reply