The 52-week money-saving challenge has been around for years for one reason—it works! Whether you’re trying to hit specific money goals, looking for vision board ideas, or just looking to start the new year off right, this money-saving challenge gives you a clear, doable plan that aligns with your 2026 savings goals.

The plan is perfect for those who need structure rather than a more flexible savings plan without a clear strategy. If you’re ready to turn your New Year’s resolutions into real action, stick with me, and I’ll show you how to make this challenge fun, flexible, and totally doable.

And to help you reach your financial goals, we have dozens of money-saving tips on the blog, including 18 realistic ways to save money and realistic ways to make extra money!

There are countless ways to save money, yet thousands of people still struggle to do so. Most of the plans I see online are unrealistic and will set you up for failure. The 52-week money-saving challenge works because it’s realistic, customizable, and easy to understand.

This post breaks it all down for you. Don’t forget to grab your free printable so you’re ready to go in 2026!

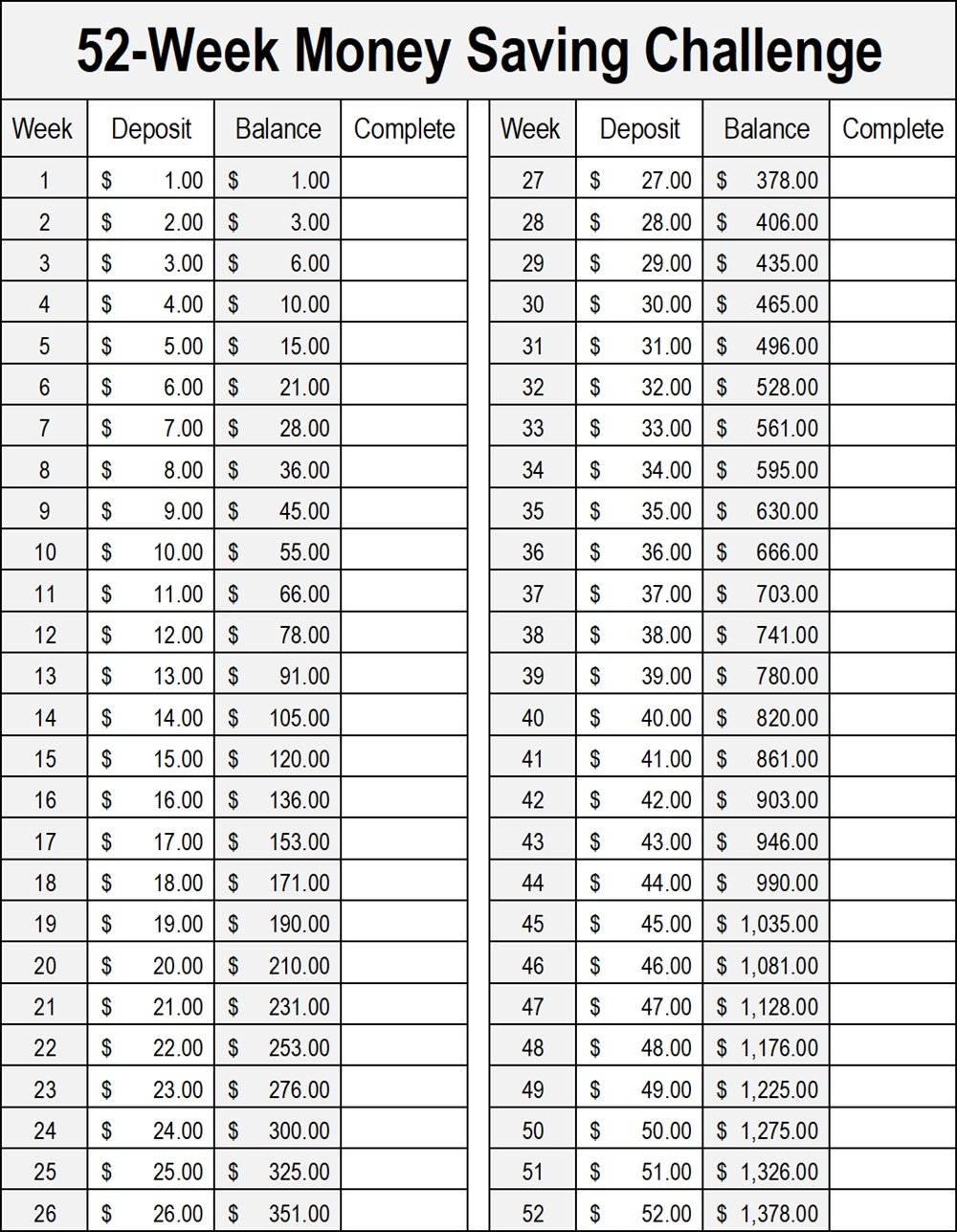

52 Week Money Saving Challenge

The 52-week plan is a super-simple way to build cash over the course of a year.

- You start small—just $1 in week one—then add one extra dollar each week.

- So week two is $2, week three is $3, and you keep going until week 52, when you save $52.

- By the end of the year, you’ve saved $1,378 without really feeling it.

It’s an easy, low-pressure way to build a steady savings habit and actually stick to it.

What you do with the money is entirely up to you. Most people use it for Christmas, while others add it to their emergency fund. Ours typically goes right into a savings account for our next Disney trip!

As for where to save it, you have options. You can add it to an existing savings account or start a new one. Personally, I add it to a high-yield savings account, which accrues more interest than a traditional savings account. It also makes it a little harder to access the money. Both options are convenient because you can transfer the money each week quickly, either online or from the app on your phone.

Variations To The Plan

There are many variations to the plan, so that you can choose what works best for you!

Reverse 52-Week Challenge

- Instead of starting with $1, you start big with $52 in week one and work your way down. It’s great if you’re most motivated at the beginning of the year or want faster results upfront.

Pick-Your-Week Challenge

- Each week, choose whichever amount works best for your budget. On tight weeks, grab a smaller number; on good weeks, knock out one of the bigger ones.

Double-Up Challenge

- If you want to build savings faster, double the weekly amounts. So instead of $1, you start with $2, then $4, then $6, and so on. You’ll save a lot more—but still in manageable steps.

Flat-Rate Challenge

- Choose a set amount—like $20 or $25—and save that every week for 52 weeks. No increasing numbers, no tracking a pattern, just a simple “set it and forget it” plan

As promised, I’ve included a free printable PDF below. Print out as many copies as you need and get ready to start saving in 2026!

52 Week Money Saving Challenge Free Printable PDF

52 Week REVERSE Money Saving Challenge Free Printable PDF

Since this needs to last all year, I like to print it out, laminate it, keep it on my fridge, and use a washable marker to check off the deposits as I make them. It stays clean and lasts all year!

I hope this post has inspired you to take on the 52-week money-saving challenge in 2026. I’m cheering for you and would LOVE to hear from you if you’ve done the challenge or have any tips to share!

I saw this earlier and started doing it as well…I thought this sounded like a relatively painless way to save a nice chunk of change…thanks for the chart though…a little added motivation.